Silver Dollar Financial is pleased to offer some of the lowest simple interest rates in our industry. What does this mean for your pre-settlement financing offer? It could be the difference between a happy end to your case and a bad one! Here’s our simple interest rate policy.

Simple Interest

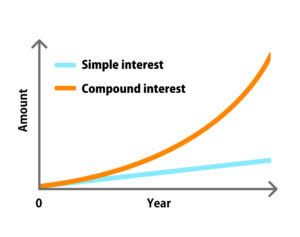

When your case finishes, we get back what we paid to you as your lawsuit loan, plus interest. Simple interest means that this is a small percentage of the offer we gave you. Any interest we charge is only ever based on your loan amount, and NOT on the additional interest.

Some pre-settlement companies use compound interest for their legal funding, and it can leave you with very little left over. You could even owe at the end! With us, even if your case goes longer than you expect, you don’t have to worry about interest eating away at your final amount.

Preserving Your Settlement

Pre-settlement financing helps you fulfill your financial needs until your full settlement comes through. Our loan offer amounts depend on your case and the information we get from your lawyer. The same goes for your interest rate.

We want to ensure that when everything settles at the end of your case, you still have a healthy payout at the end. Using tricks to swipe more money out of your settlement is bad for you and bad for our business! We depend on word of mouth, so we want to make sure our interest rates are fair.

Before you agree to an offer, we’ll go over everything you need to know to understand just how much your settlement will pay us back at the end. No surprises!

Get an Offer for Pre-Settlement Funding Today!

If you’re struggling with your bills while you wait for your settlement to come through, don’t wait. Silver Dollar Financial is ready to offer you simple interest pre-settlement financing. Pay for your bills while you recover from your injury with our help. Apply now and tell us about your case.